How brands can navigate the modern beauty landscape

The beauty and personal care industry is undergoing a massive transformation, as consumers react to economic pressures, incorporate new technologies in their purchase journey, and continue changing their product preferences. New research from our partnership with WPP Media and Ipsos reveals key trends shaping this industry. Based on a survey of over 9,000 recent beauty or personal care consumers across six global markets (US, UK, CA, KSA, FR, IN), the findings offer brands actionable insights into how buyers discover, evaluate, and purchase products.

Inflation is Real, But ✨Treat Yourself✨

Despite economic concerns, consumers are still actively engaged with beauty. While 65% of beauty buyers admit to waiting for promotions or offers before making a purchase, a huge 67% have tried new beauty products in the last year, and 66% are open to exploring new and emerging trends. This indicates a strong desire for indulgence and self-care, even in a deal-driven environment.

Notably, daily Snapchatters are 1.3x more likely than non-Snapchatters to try new trends and are 1.5x more likely to shop premium beauty brands, demonstrating a willingness to invest in quality despite inflationary pressures. This was a similar pattern across the personal care sub-category too.

Loyal, But Impulsive

Most beauty and personal care shoppers are loyal to their favorite brands. 73% of personal care consumers tend to stick to the same personal care brands, and 77% are likely to trial new launches from their favorite brands.

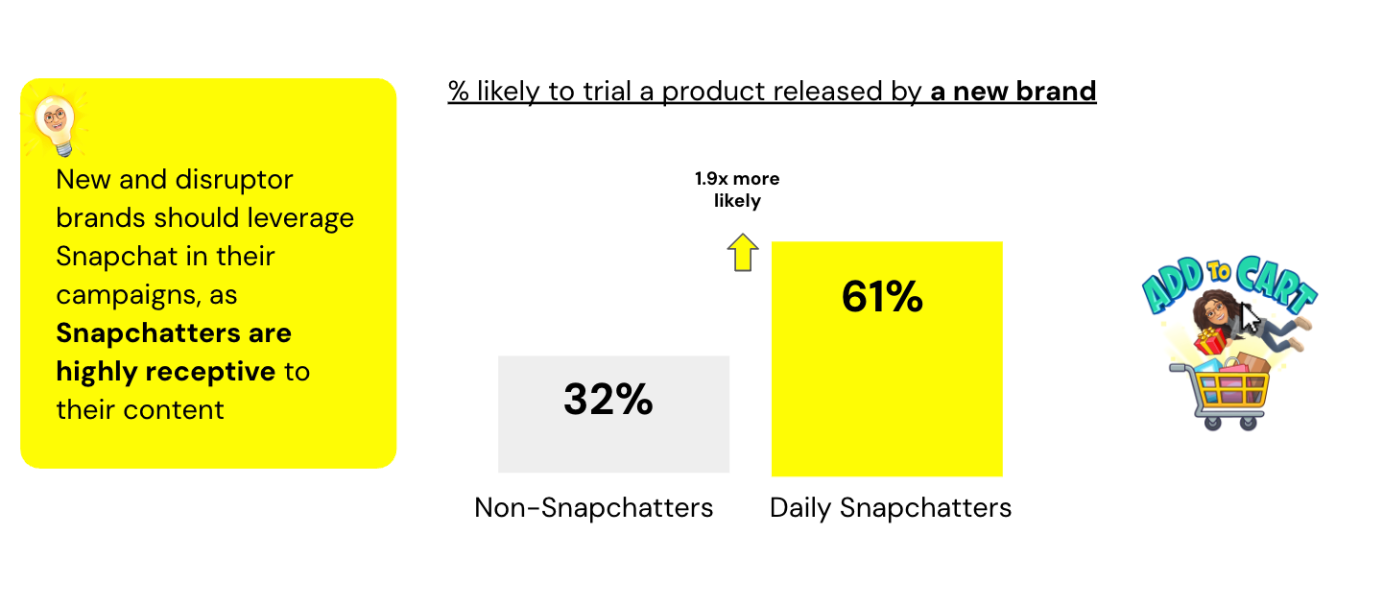

However, this loyalty doesn't negate the power of impulse. Our study reveals that 52% of personal care buyers often make impulsive personal care purchases, with daily Snapchatters being nearly 2x more likely to do so than non-Snapchatters. This spontaneity extends to new brands as well, with daily Snapchatters nearly 2x more likely to trial products from new brands. Brands need to cater to both the desire for trusted routines and the thrill of new discoveries.

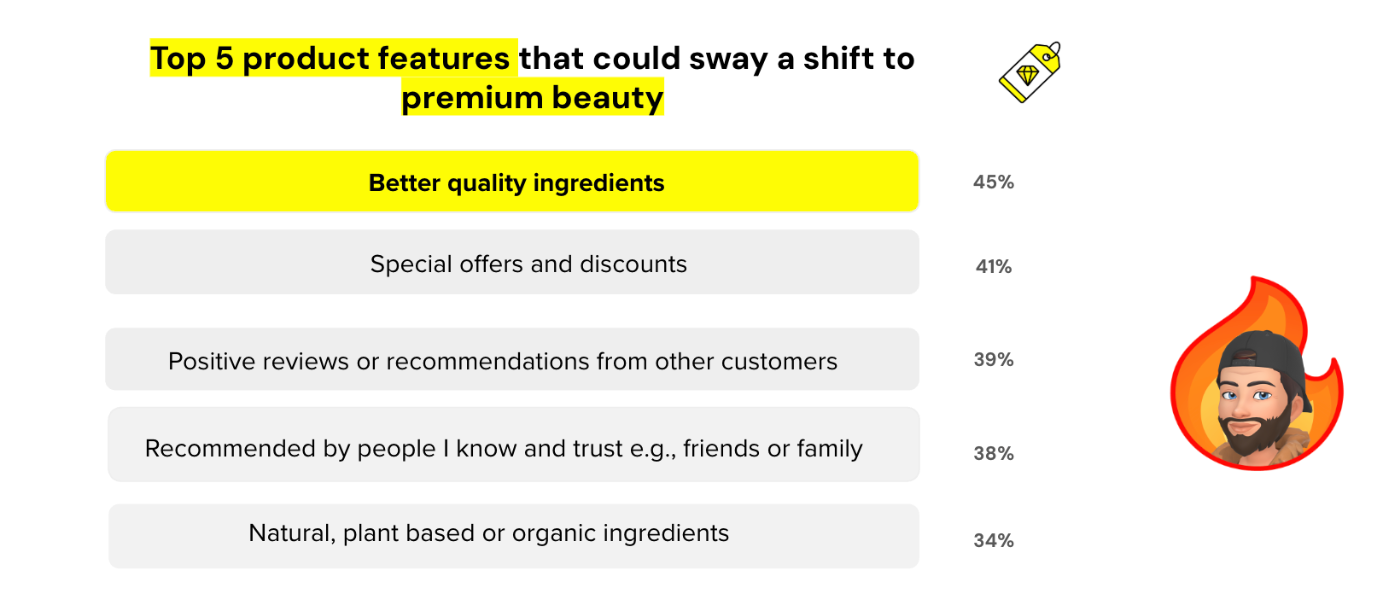

Standards Are Getting Redefined

The standards for beauty and personal care purchases are evolving, with quality and ethical considerations taking center stage. For example, "better quality ingredients" is the top product feature that sways consumers towards premium brands. Technology is also playing a significant role in determining which products to buy, with 40% of beauty buyers engaging with tech-driven trends such as buying products based on AI recommendations. Notably, daily Snapchatters are 2.4x more likely to use tech in their personal care purchase journey than non-Snapchatters. This highlights a shift towards conscious consumption and an openness to innovative solutions, especially amongst Snapchatters.

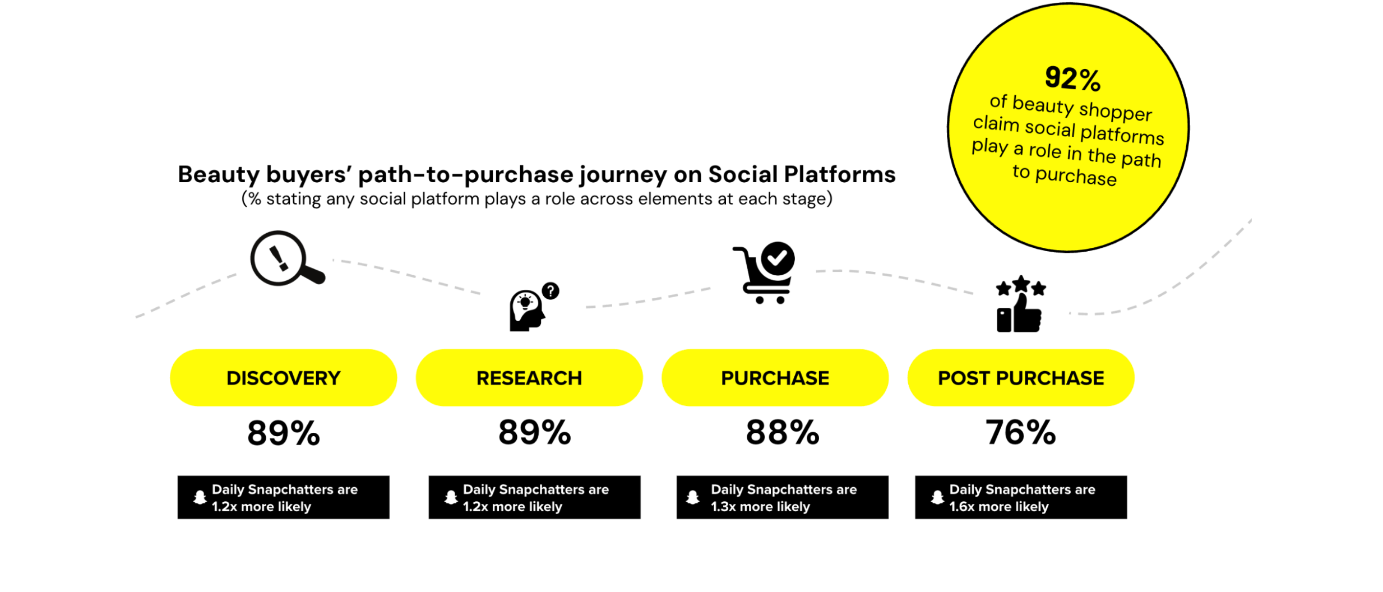

Social Drives Discovery and Purchase

Social platforms are indispensable to the beauty and personal care path to purchase. At least 9 in 10 shoppers claim social media influences their beauty or personal care journey.

Snapchatters in particular lead the charge in this digital landscape. Daily Snapchatters are 1.7x more likely than non-Snapchatters to discover new personal care trends on social platforms and 2x more likely to buy more personal care products due to social media.

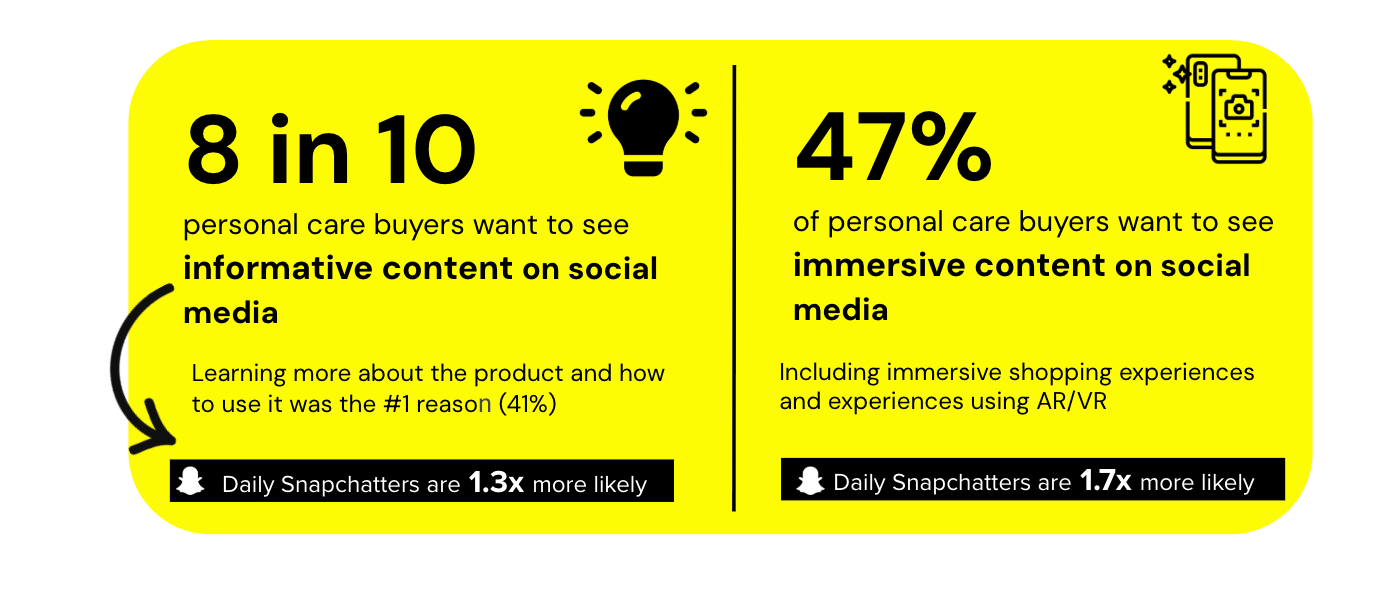

For brands, one of the best ways to engage consumers on social platforms is to provide informative and immersive content. 8 in 10 consumers want to see informative content on social, so they learn more about the product and how to use it. Almost half of consumers want to see immersive content on social, like AR experiences. Notably, almost 80% of beauty buyers show interest in AR experiences, and Snapchatters are 2.1x more likely to buy from brands offering AR.

Shoppers Want Personal Recommendations, But Public Approval

Friends and family are central to the purchase journey, with 93% of consumers stating their inner circle influences at least one point of their beauty/personal care purchases. This extends to social conversations, where daily Snapchatters are 1.6x more likely to chat with friends and family about beauty purchases via social platforms.

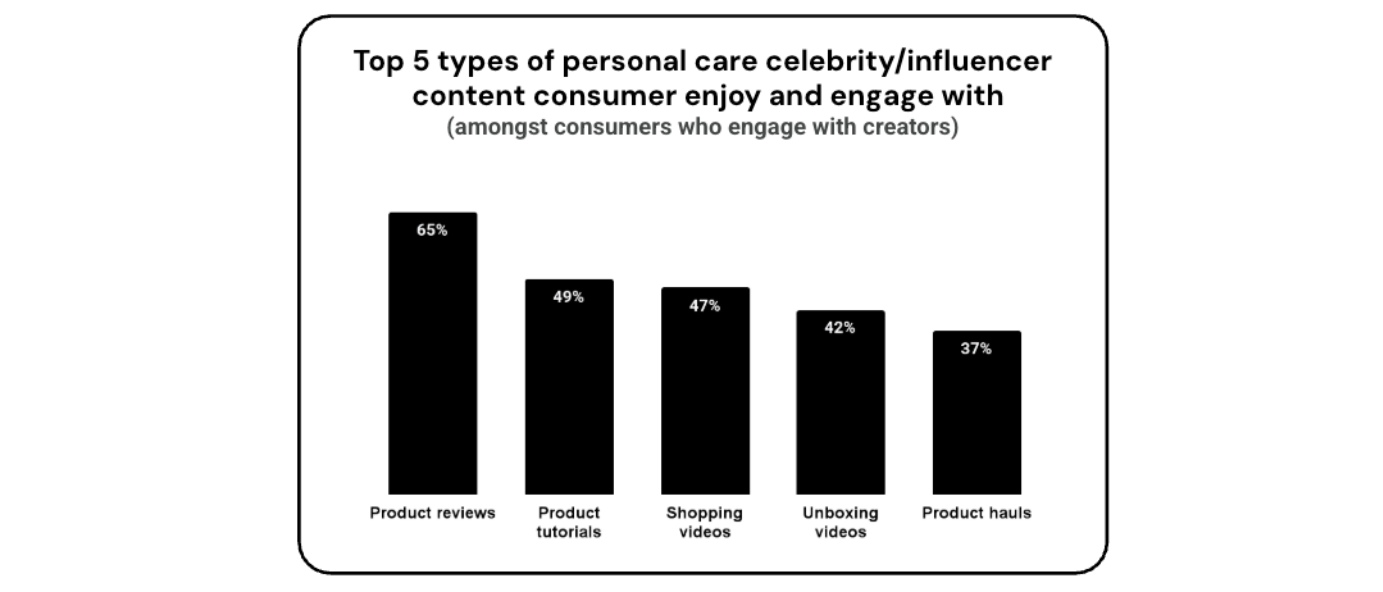

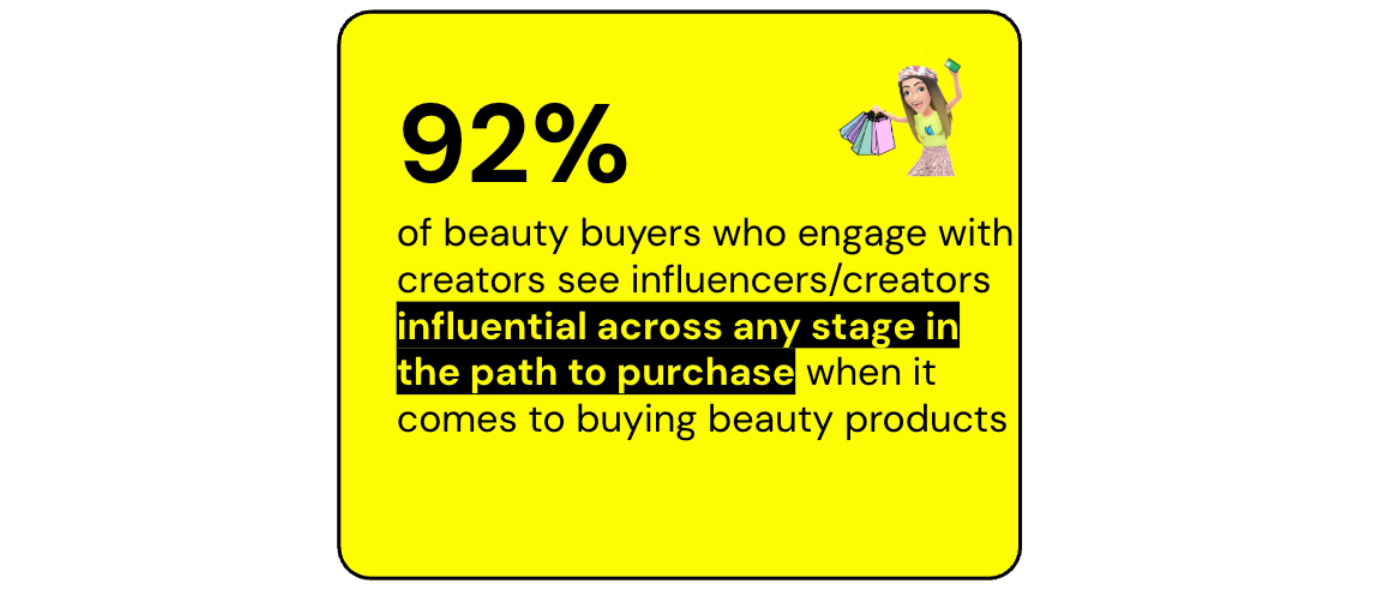

Beyond personal connections, creators hold considerable sway, especially those perceived as experts and showing product reviews.

77% of consumers engaging with creators buy the beauty or personal care products they have launched or endorsed. Those who engage with creators trust them, with 7 in 10 agreeing that they trust such reviews. 67% are also likely to trial new launches endorsed by creators, with Snapchatters 1.4x more likely to do so.

What Does This Mean for Brands?

To succeed in this dynamic beauty and personal care landscape, brands must:

Tap into social and economic trends Showcase products that align with consumer desires and address the ongoing challenges of inflation.

Drive loyalty and embrace impulsivity: Cultivate brand loyalty through effective communication and loyalty programs, while also creating eye-catching content that appeals to spontaneous purchase moments.

Build a strong social presence: Leverage social platforms for visibility across every stage of the consumer journey, from discovery to post-purchase. Embrace immersive and AR experiences for further engagement.

Capitalize on the influence of others: Engage with inner circle conversations where product discussions are happening on platforms like Snapchat. Partner with quality, expert creators to reinforce brand credibility and relatability, fueling a cycle of inspiration, engagement, and purchase.

Source: 2025 Ipsos vertical study commissioned by Snap Inc.

Related News

Snapchat can help your business grow.