Start Your Holiday Campaigns on

Snap Now

Q4 is the make-or-break moment for performance advertisers. As we head into the holiday season, we gathered the latest insights from across Snap’s advertiser ecosystem to help brands looking to make the most of their end-of-year campaigns. The takeaway? Start advertising on Snap today to stay ahead of the Q4 curve.

Why Snap? Why Now?

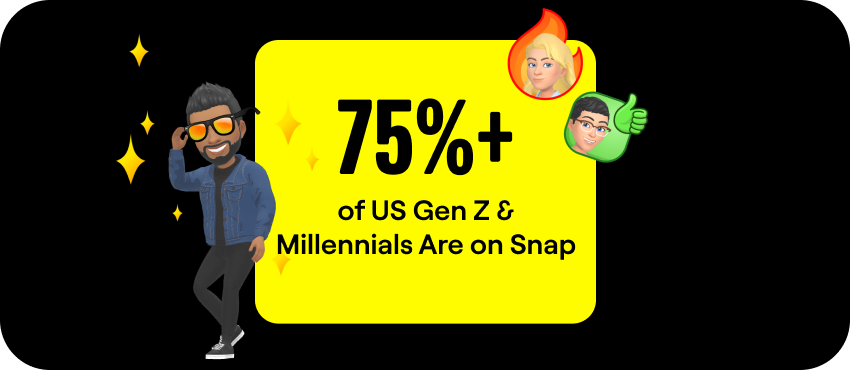

Reach Gen Z and Millennial Audiences 1

Snap is the home of high value, high-intent shoppers you can’t afford to miss. 2

75% of Gen Z and millennials are on Snap in the US and 25+ other countries, and they’re ready to find new ideas, discover brands, share products, and fill their carts. 1

88% of Snapchatters say they love to shop, and they outspend users on other platforms across key categories such as apparel and beauty, creating a unique, high-intent environment that drives efficiency and results.

45% of Snapchatters plan to spend more on holiday shopping this year than last and are almost two times likelier to spend over $1000 on gifts. 3

Holiday Shopping Starts Early on Snap

While it may seem like Black Friday and Cyber Monday are where campaign focus should reside in Q4, Snapchat’s unique audience began checking off their lists long before that. 4

Two-thirds of Snapchatters say they start gathering gift ideas in July.

60% are in the planning stage by September and October

26% are already buying gifts in October.

It’s not all happening the week of Black Friday and Cyber Monday, but discovery now can lead to a greater return when that time comes. Snap is a communications platform where ideas, gifts, products are easily sharable, and peer validation can help move shoppers from inspiration to purchase.

30% of Snap users have purchased from brands they first saw on Snap

48% of Snapchatters say they are likely to send or receive gift ideas on the platform this season. 3

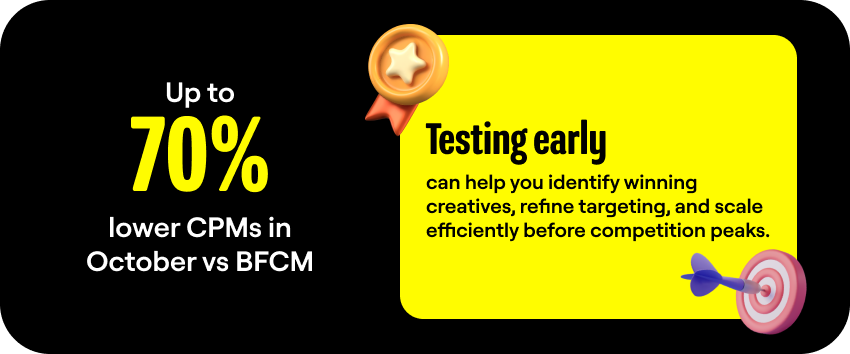

Don’t Wait Until It’s Too Late

Early activations can lead to stronger conversions and CPMs.

CPMs can be up to 70% lower in October compared to Black Friday/Cyber Monday.

Testing early can help you identify winning creatives, refine targeting, and scale efficiently before competition peaks.

CPM’s surge in November, and can be up to 70% lower in October in contrast to the Black Friday/Cyber Monday weekend. 2 Ahead of this spike, it’s best to know what creatives are working, what audiences to target, and what your opportunities on Snapchat are. Launching early provides lower costs and better opportunities for testing.

TLDR

Advertising on Snap early can help maximize end-of-year results.

Snapchat connects you with Gen Z and Millennial shoppers.

We unpacked these insights and much more during our Shopping Season Webinar. Interested in gaining more insight into performance on Snapchat? Explore success stories from our Snap partners to see how performance brands are winning this holiday season.

Ready to launch your first holiday campaign? Get started below.

More Ways To Win With Snapchat

Snapchat can help your business grow.