The Future of Finance is Social: Engaging the Next Generation of Wealth

Financial decisions are no longer made in spreadsheets or bank branches. They happen during major life changes, on social platforms, and increasingly with the support of AI and AR technology. In collaboration with Horizon Futures, we commissioned Ipsos to conduct a quantitative study of 1,100 daily social media users in the US who hold or are seeking financial products. This research focuses on the 18–44 demographic to analyze their interactions with financial brands, identifying key "trigger moments" to adopt new products and evaluating the growing influence of social platforms as a primary source of financial education.

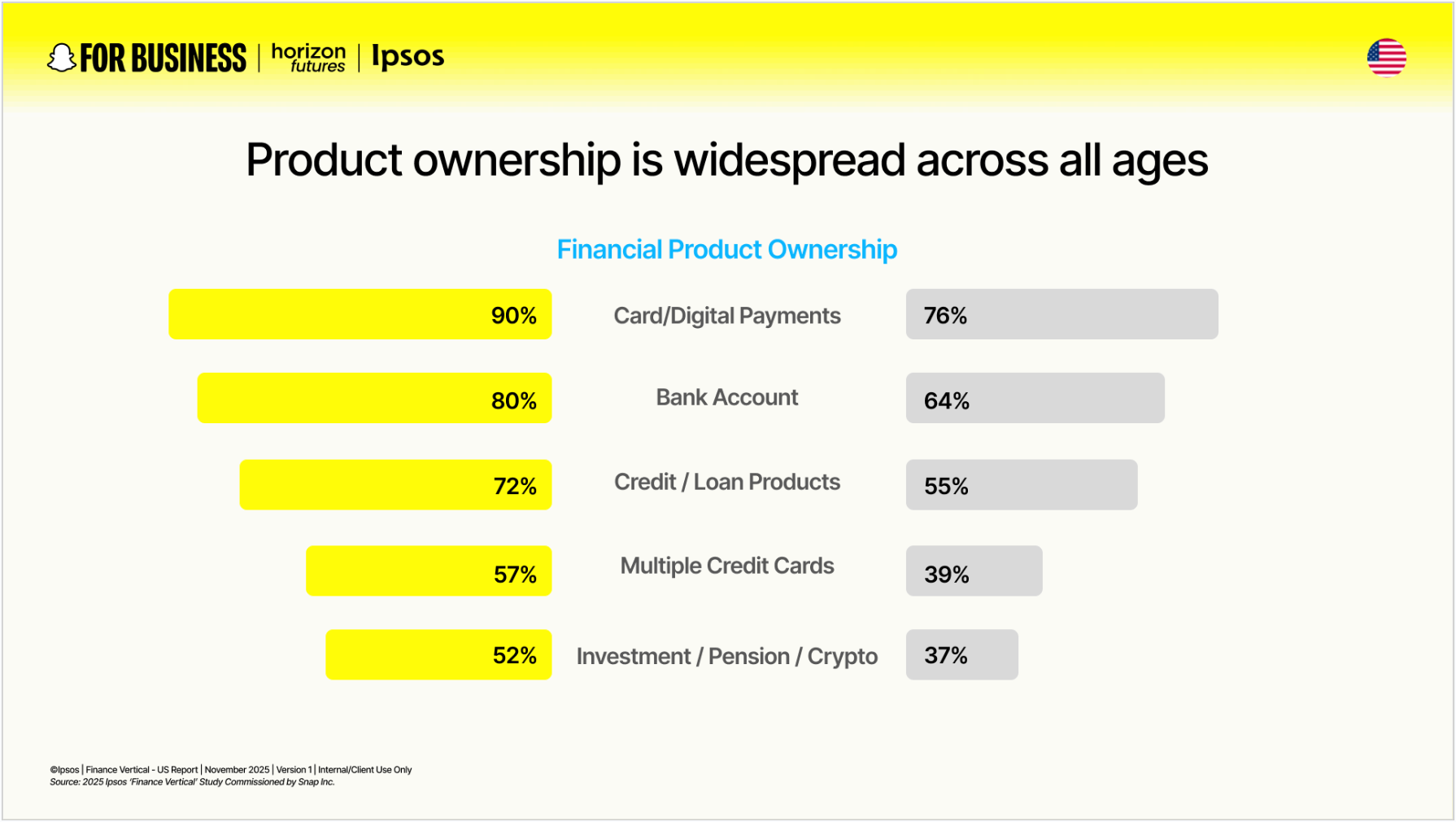

The 95% Club: Financial Participation is Nearly Universal

The next generation of wealth has arrived. Research shows that 95% of 18-44-year-olds in the US have at least one financial product (e.g. a credit card or bank account). While Millennials lead with an average of five products, Gen Z is closing the gap fast, holding an average of 3.7 products each. In particular, daily Snapchatters are in the market for new products and are 1.4x more likely to take out a new financial product in the next six months compared to non-Snapchatters.

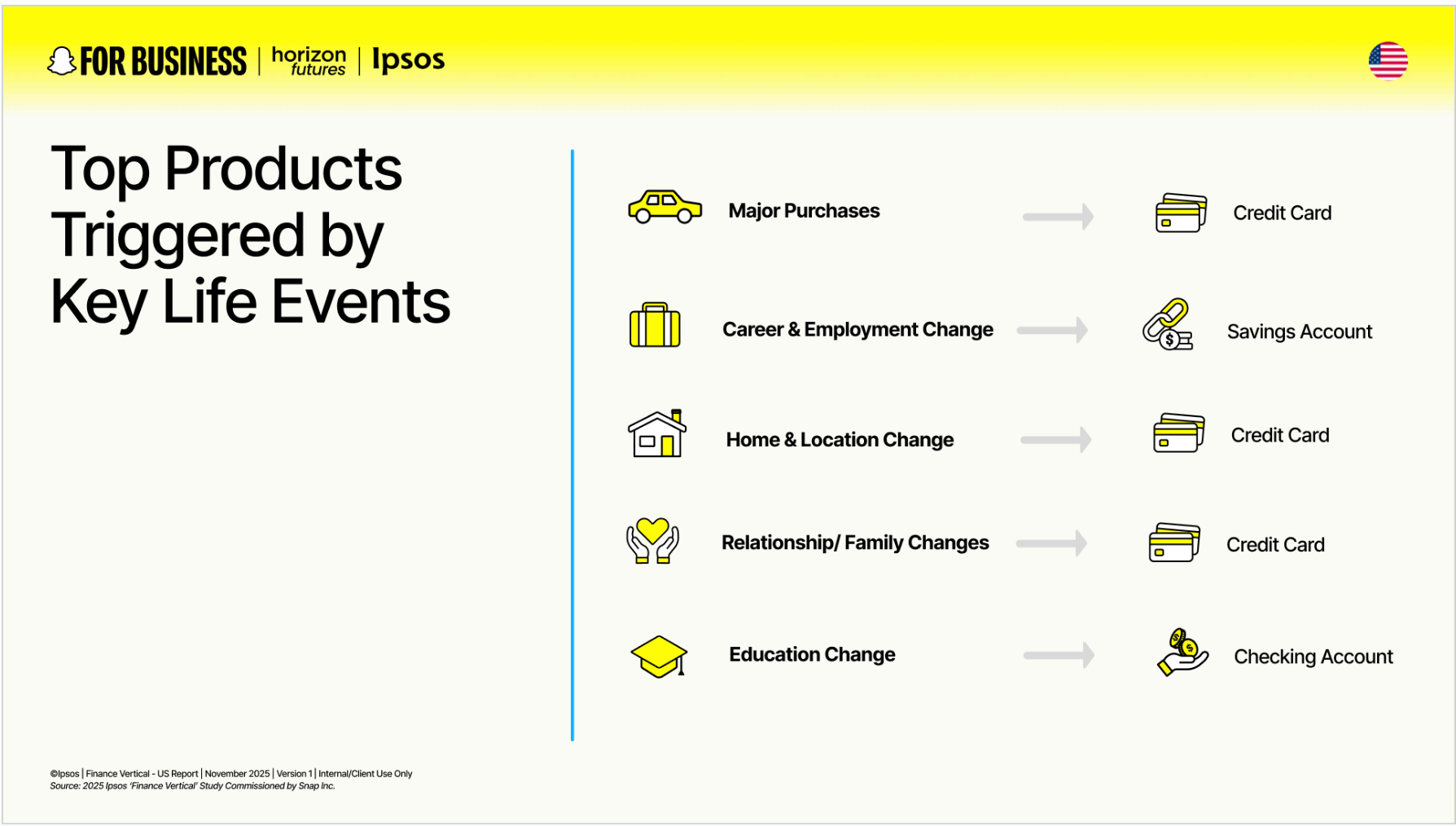

Key Life Moments Create Financial Needs

For many young people, life transitions (like career or family changes) are the primary catalysts for seeking out new financial products. 85% of financially engaged US consumers who experienced a life event in the last year then changed or got a new financial product.

For Gen Z, almost 8 in 10 say they experienced a major life event in the past year, and 3 in 4 are anticipating at least one more in the next 12 months. They are also more inclined to adopt financial tools or products during career or educational transitions. Meanwhile, Millennials are more likely to seek them out when making major purchases, such as a new car.

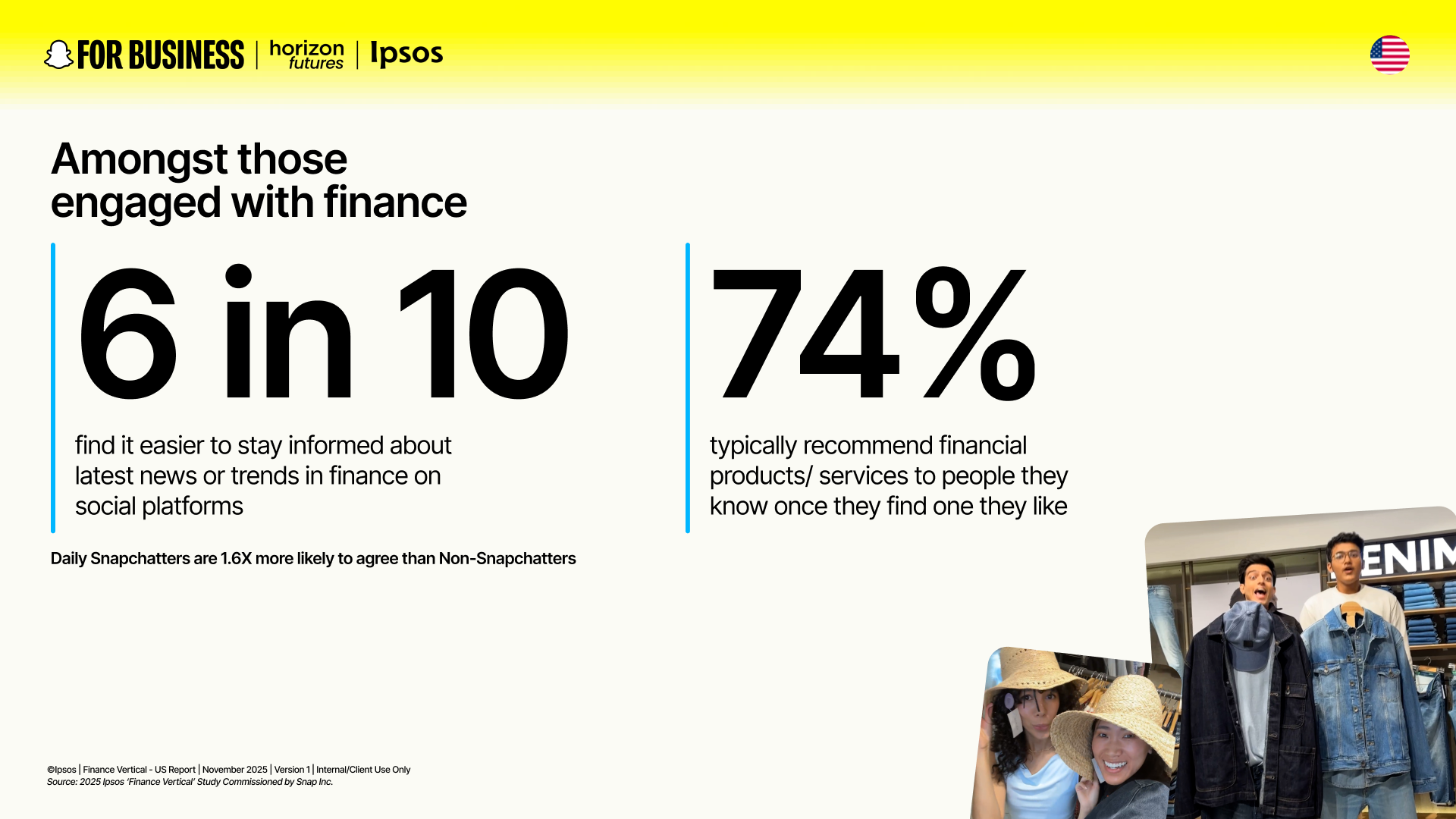

Social Media is the Financial Classroom

While there's strong interest in financial products, 82% of consumers feel they need more education to navigate complex options like crypto and pensions. Because social is the default environment for learning and decision making, it’s a must-have for brands to engage and drive action. Of those who own or are seeking financial products, 8 in 10 say they would like to see educational content from financial brands on social media.

The opportunity doesn’t stop at education. Having a presence on social can lead to customers trying those products and recommending them to their networks. Moreover, Snapchatters are 2X more likely to try a new financial product or brand after seeing it on social platforms.

We're witnessing a fundamental cultural shift in how financial confidence is built. It's no longer a top-down lecture from traditional institutions, but a peer-to-peer conversation happening in the digital spaces where the next generation lives, learns, and connects. For brands to succeed, they must evolve from being a distant authority to being a trusted, authentic voice within that community dialogue.

Laura Sammartino

SVP Horizon Futures, Consumer & Culture

Snapchatters are Leading the Charge

Financial decisions today are shaped by confidence, social context, and access to information at the right moment. Snapchat is where many of these moments naturally unfold, as people stay connected to friends, track life changes, and explore what comes next.

Daily Snapchatters are more likely to feel in control of their finances and confident in their decision-making. They are 1.6x more likely to report positive financial health and 1.6x more likely to use digital channels to plan their finances. This signals a willingness to learn, explore, and engage. This confidence also translates into experimentation, with Snapchatters being 1.8x more likely to take calculated risks in pursuit of higher returns.

AR & AI: Bringing Finance to Life

As consumers increasingly turn to digital tools to manage their money, emerging technologies like AI and AR are becoming essential to how financial information is understood, not just accessed. These tools help reduce complexity, build confidence, and turn abstract financial decisions into tangible experiences

Four in 10 consumers want to see interactive product guides on social platforms, and half are already using AI or emerging tech more than they were a year ago.

This shift is especially pronounced among Snapchatters, who show 2.1x higher interest in using AR to learn about financial products. By allowing consumers to visualize options and explore scenarios before committing, AR and AI can help bridge the gap between curiosity and confidence.

Key takeaways for brands:

Focus on life events 🏡

Engagement in the finance category is already high and spans multiple product areas, but the real opportunity lies in what comes next. As life progresses, new financial needs emerge, especially for Gen Z, who are earlier in their financial journeys and just beginning to form brand preferences. Winning Gen Z early is not just about immediate conversion. It is about building customers for life, driving higher retention, deeper product adoption, and long-term customer lifetime value. Brands that show up consistently during key life moments can earn trust early and remain top of mind as financial needs evolve.

Help bridge the education gap 💸

Consumers are actively seeking guidance, but they want it delivered in a way that feels approachable and relevant. Educational content on social works best when it simplifies complexity and meets people in the language they already use. Creators play a critical role here. They help translate financial concepts into relatable, real-world scenarios, building trust through authenticity rather than authority. When education feels peer-led instead of prescriptive, brands are better positioned to earn confidence, consideration, and long-term loyalty

Embrace emerging tech ❇️

Emerging technologies and innovative products are actively shaping the future of finance, and brands that embrace them are better positioned to meet evolving consumer expectations. AI and AR are becoming integral to everyday financial lives, helping people explore options, compare scenarios, and build confidence before committing. AI-driven recommendations and reminders can support ongoing decision-making, while AR makes abstract financial choices more tangible. Together, these tools reduce complexity and help turn intent into action

Harness the power of social ⚡

Financial decisions no longer happen in isolation. They are influenced by conversations with friends, shared experiences, and social validation along the way. Social platforms play a central role in discovery, education, and recommendation, making them critical to the full financial decision journey. Brands that invest in social are not just driving awareness. They are embedding themselves into the moments where confidence is built, opinions are formed, and choices are ultimately made.

More Ways To Win With Snapchat

Snapchat can help your business grow.