Why Advertisers are Switching to Snapchat

The number of Snapchat active advertisers more than doubled year-over-year.¹

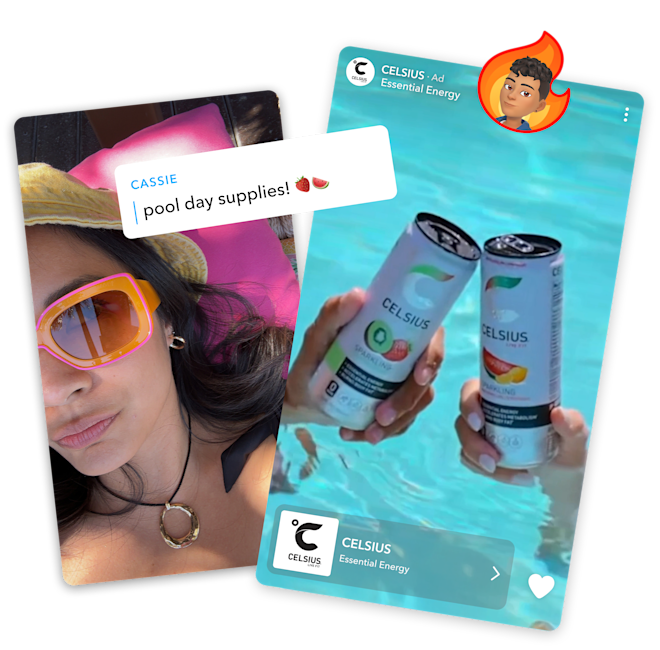

Gen Z & Millennial Audience

Snapchat reaches 90% of 13–34-year-olds in the U.S.² with $5T in spending power.³ Over half of daily TikTok users aged 16–24 also use

Snapchat daily.⁴

Brand Safe

We partner with trusted providers like Integral Ad Science, a leading media measurement and optimization platform, to invest in brand safety & suitability. In an IAS study, Spotlight and Creator Stories content was found to be 99% brand safe on average.⁵

Creators that Deliver Results

Snapchat beat both TikTok and Instagram in creator-driven shopping: 85% of social shoppers who said Snapchat content led them to make a purchase, also said they made a purchase because of creator content.⁶

Return on Ad Spend

Snapchat ranks top 3 in ROAS across 10+ media channels. For commerce and tech brands, it’s the most efficient option.⁷

Conversion Efficiency

Snap reaches more unique prospects per dollar and drives faster conversions—second only to Paid Search.⁸

Meet your audience where they are —

at every stage

Drive Awareness

Drive Consideration

Drive Conversion

Frequently Asked Questions

Can I repurpose ads from other platforms?

Snapchat Ads have a 9:16 aspect ratio, which is the same as many other platforms. You may have to edit your ads to fit Snapchat’s safety zones. You can preview what your ads will look like by uploading them to Snapchat Ads Manager.

What style of ads perform well on Snapchat?

The Snapchat audience is made up of Gen Z and Millennials who discover new brands and products via social influence such as content creators or influencers, or even regular people in their social network. This means content that features people speaking directly to the camera or conversing with one another fits well on Snapchat.⁸

Start your success on Snapchat today